Building best-in-class financial models is our core expertise at LMS.

Our Models

Our models have valued and provided financial close on transactions with a cumulative value in billions of dollars, and we have done this across the full spectrum of major industries, such as mining, energy and infrastructure.

Ultimately, our success is based on the quality and deep experience of our modelling team, but also on employing a clear and formalised scoping process and a thought-leading best practice modelling methodology – please see below for more detail on both.

Our Process

Contact Us

Contact LMS by email or phone and we will undertake an initial ‘needs analysis’. This will identify how we can help and identify a framework for scoping.

Scope Requirement

At this critical stage scope will be discussed in detail with all relevant stakeholders. Scope will in turn be documented, reviewed and adjusted until agreed in full by the client.

Model Build

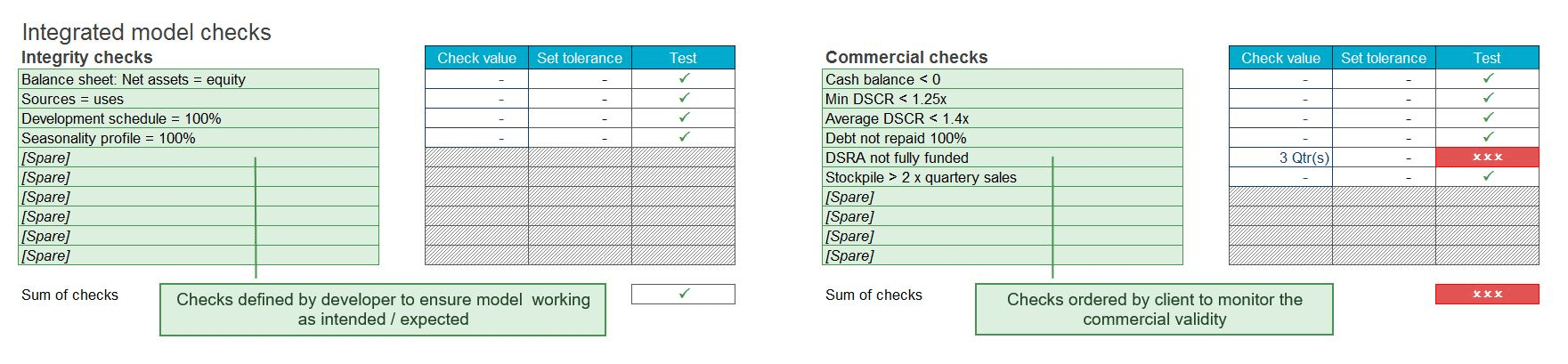

Model will be developed to the agreed scope and our best practice modelling standards. Model will be integrated with automated checking, log and communication tools too.

Iterations

After delivery of an initial draft the client will review model and return comments for refinement, if required. Final changes will then be made and a full mechanical review of the model undertaken.

Final Delivery

We will seek client sign off on final delivery and then provide model-use training to key users to ensure all model knowledge is transferred to the client for quick and easy adoption.

Scoping your requirement

The most important stage of producing any fit-for-purpose and best-in-class model is the model scoping process with the client. We prefer to do this face-to-face where possible, but are available for video-conferencing sessions for this stage too.

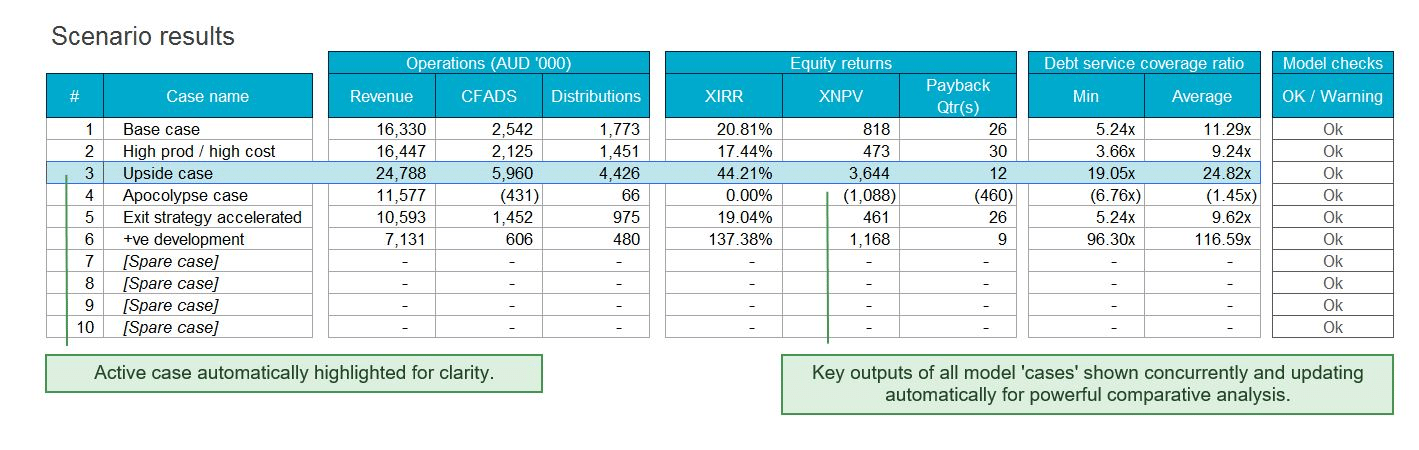

Ultimately, all our models are tailored builds to the specific analytical requirements of our client. Though importantly for all models we utilise the same best practice methodology and also integrate some useful common features and tools.

For the ‘Scope requirement’ stage, the general process is as follows:

- In ‘Needs analysis’ at initial contact we will establish the general requirement and the number of stakeholders involved. This will initially dictate who we need to speak to and the likely time needed to scope the requirement.

- Client and various stakeholders will identify in detail the requirement and ultimately, the primary and secondary key roles and output(s) of the financial model – i.e. establish the questions you want answered.

- LMS will identify any potential problems with the requests and resolve these with the client.

- LMS will document and deliver a defined scope of works to the client for review, outlining the general intention of the financial model, but also in detail its part-by-part intended input, calculation and output structures and functionality.

- After any necessary adjustments are made and scope is agreed, LMS will deliver a full engagement proposal specifying, in addition to scope, development and delivery timeline, and cost estimate.

Our modelling methodology

At LMS we build truly best-in-class financial models. The techniques we employ have been cherry-picked from the most developed and clarified thinking on best practice financial modelling worldwide, but in particular from the UK and Australia. These techniques have then been further refined by our in-house team, who have over 40 years of combined modelling experience.

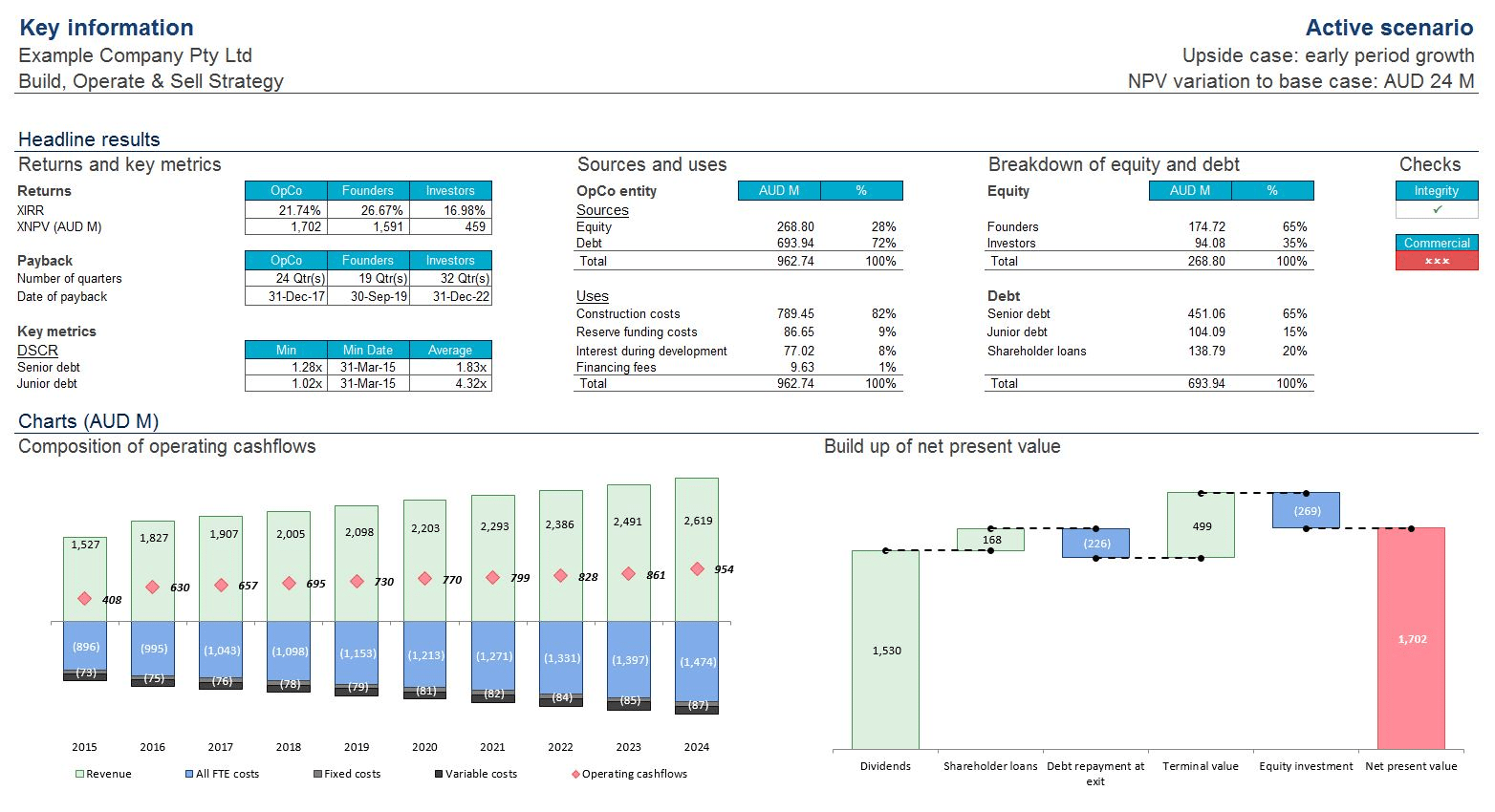

Simply, the result is models which are:

Very Presentable

Making models accessible for users, but also importantly to ensure they fulfil their role as a ‘sales document’ where required

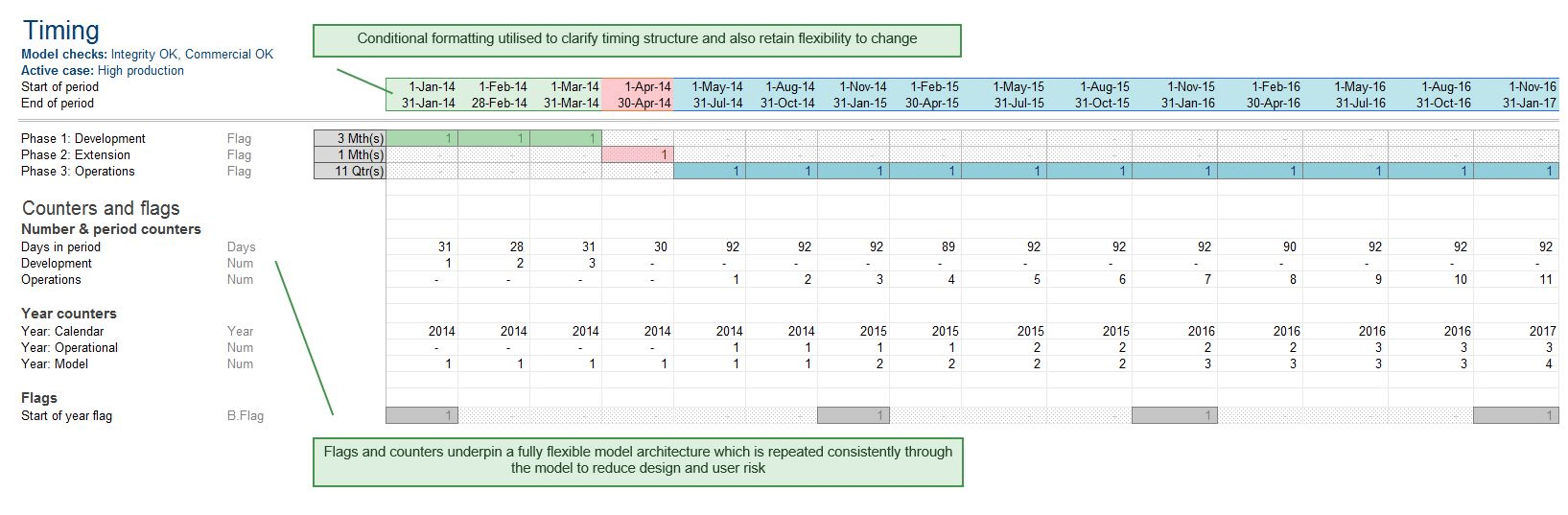

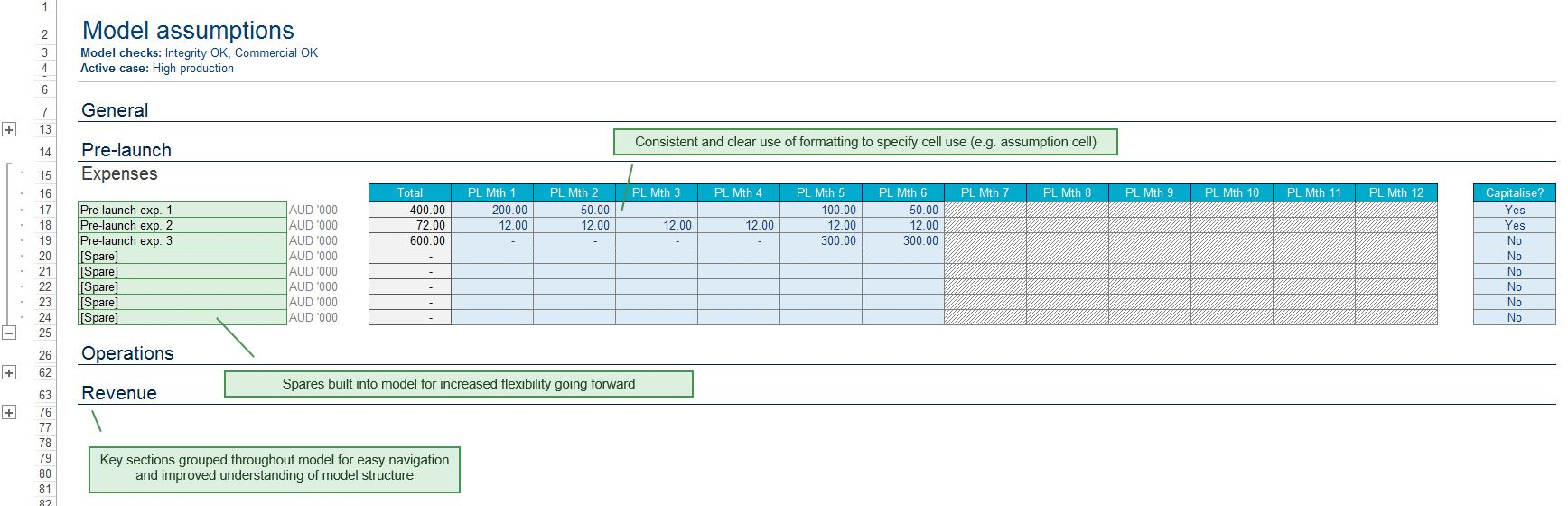

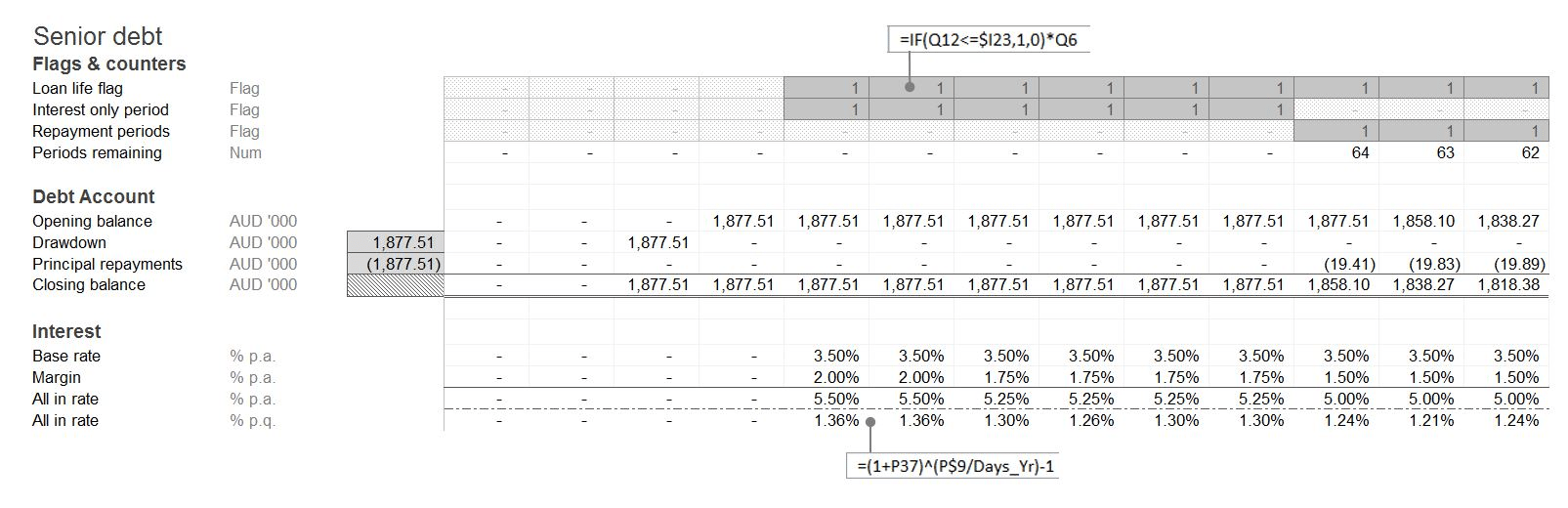

Low Risk

Architecture and formula in our models follow best practice principles that lower developer/user risk in a robust, hard-to-break structure

Easy to use

Using consistent style and clear instruction our models are developed so that anyone can quickly become a confident user

Highly Flexible

We ensure our clients’ models are not just for analysis today, but for use in the future by developing inherent flexibility in structure & inputs

Testimonials

We were in the process of a major round of capital raising for the expansion of the SleepFit business. We needed a robust financial model that provided a near and mid-term forecast, based largely on a range of differing customer groups, numerous service offerings and a complex opportunity filter.

LMS sat with us to understand the business and continued to work with us closely until we had fine-tuned a financial model that was sophisticated, but also assessable and which provided a powerful tool for selling our proposition to new investors. I highly recommend LMS, no matter how complex the business or project being modelled.

We first engaged LMS back in mid-2015 to build a corporate model and were so impressed by the modelling, communication and value for money received from the team there that we haven’t gone anywhere else for our modelling requirements since.

LMS have helped us additionally with a capital raising model and a transaction model and ultimately, what we like about the models LMS produce is they have all the bells and whistles and scenarios that we ask for, but critically still remain easy to use for us and very presentable for external distribution.

We engaged LMS to undertake all the modelling for the financial and economic appraisals that constituted key elements of the final business case for the Transport Access Program (tranche 2) that Stonepath Consulting was tasked with developing by Transport for NSW (our client). It required unpacking a number of legacy issues as part of the modelling exercise and close integration of various data sets before the analysis could be undertaken. LMS excelled at these challenges and produced a robust financial model that received much praise from the client. We continue to involve LMS in other similar opportunities.

Our Clients